Welcome to The Dubai Short-let Market Review Q2 2024 Report by The AirDXB Group.

This report provides insights on trends and statistics impacting investments into Dubai’s real estate market, with a focus on short-let.

The global short-let market faces varying regulatory challenges and impacts. In countries like the UK, US, and Spain, criticism has intensified over the economic and social implications of short-term rentals on local communities. Barcelona, for instance, plans to eliminate thousands of short-term rentals by 2028.

In contrast, Dubai exemplifies a successful model with well-regulated short-term rentals supporting both investors and tourists. Dubai’s success in achieving this balance is shown by various accolades such as the TripAdvisor’s Travelers Choice Awards 2024 (third year in a row). As debates continue globally, Dubai’s approach highlights potential pathways for balancing economic growth with housing and tourism concerns.

Top Short-let Trends Q2 2024

Dubai’s short-let market surged with professionally managed properties experiencing significant increases in average daily rates. There was a 34% rise in April, followed by 28% increases in both May and June compared Q2 2023. This spike correlates with a surge in tourist numbers and dwindling short-let availability, driving up investor returns. Revenue from managed apartments mirrored this growth, climbing by 24.5% in April, 12.09% in May, and 29.5% in June. The trend underscores Dubai’s allure as a lucrative short-let investment hub, backed by “The UAE Tourism Strategy 2031”.

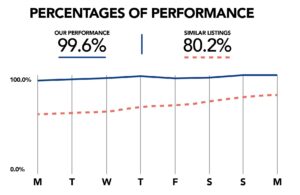

The AirDXB occupancy rate continues to soar above market averages, demonstrating sustained high occupancy rates month after month. Our Q2 average occupancy rate was an impressive 94.6%, compared to the market average of 53%.

The Dubai Real Estate Market Q2 2024: Key Trends for Investors

Residential real estate transactions grew by an impressive 20.5% year-on-year. This consistent growth indicates robust market dynamics and heightened buyer interest. Total property sale transactions reached a staggering 43,612 reflecting the market’s resilience and positive outlook.

Sheikh Mohammed approved AED 30 Billion rain drainage network. Project Tasreef will increase Dubai’s rainwater drainage capacity by 700%. By investing in infrastructure to manage heavy rains effectively, Sheikh Mohammed is demonstrating his commitment to maintaining property values and minimizing damage risks.

The Dubai real estate market set a new record with 17,000 properties sold in May, marking the highest number since 2009. The persistent demand for properties in Dubai remains robust, appealing to both UAE residents and international investors.

↓Discover more detailed insights and strategic analysis in the report below.↓